Traditional mortgages

You must escape from the clutches of the banks.

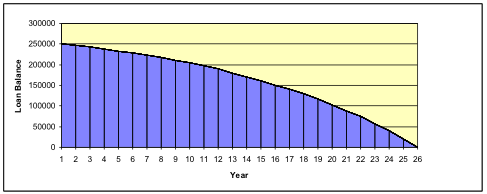

Initial 25 years Principal & Interest Loan for $250,000 Interest rate at 7.25% per annum

Repayments of $1,807.02 per month

This means yearly repayments of $21,684

So over the first 5 years you have paid a total of $108,421 FOR WHAT.

To reduce your principal mortgage amount by only $21,372

DOES THIS SEEM FAIR ?

How Traditional Mortgages Work

This mortgage takes 19 years before more of you monthly repayments are directed to the repayment of the principal rather than simply meeting the interest costs!

Personal Debt Reduction.

We would like to see you speed up the reduction in your home loan and other personal debts. Our investment process has the ability of combining a debt or mortgage reduction process, which will speed up the elimination of this non-tax deductible or personal debt.

The deregulation of the Banking system over the last few decades, combined with competitive pressures, have lead to the introduction of many innovative financing arrangements, mostly designed to allow borrowers to have more flexibility in the way in which they manage debt.

This started some years ago with the facility to make loan repayments more frequently than once per month, thus reducing the outstanding loan balance more quickly, and therefore paying substantially less interest over the term of the loan. The facility to re-draw same, or all, of the re-paid principal followed, and that has now developed into what amounts to a “private borrower’s overdraft”, or a “revolving line of credit”. These are interest only loans, where the interest is calculated daily on the outstanding balance and is payable monthly in arrears.

The ability to have all income (wages, salaries, dividends, rental income, government payments etc.) credited directly to such an “line of credit” account along with the ability to link credit cards for purchasing with up to 55 days interest free, debit cards for Automatic Teller Machine access to funds (cash) and to arrange direct debits for bill paying, has lead to a huge groundswell of interest in these facilities.Such arrangements have the ability to give unprecedented flexibility in debt management, which can result in considerably reduced loan terms, huge reductions in loan interest paid and greatly enhanced access to liquid funds.You become the bank manager.

Personal Mortgage Reduction Strategy via The Line Of Credit.

The recommended strategy is simple. The strategy combines the advantages of free access to the bank’s money and the flexibility that is now, available through banking (innovations that have happened through deregulation in 1985,

For the success of this program, it is essential that you take responsibility our own spending.

Any regular payments (e.g. interest on investment loans, life insurance premiums etc) are to be withdrawn automatically from The L.O.C. Depositing your income into The L.O.C.has the effect of lowering your debt level, which in turn lowers the amount of interest that this debt is generating and which has to be paid by yourselves. Even though at times there will only be a small reduction in interest payable, over the longer term this strategy can cut the term of your loan in half, or even a quarter As you continue along the debt reduction path, you will be building up equity in The L.O.C.when this occurs, we will recommend further strategies which will assist you in building personal wealth.

The rationale of a debt reduction system is that with this alternative. You do not need to increase the amount of your mortgage repayments to reduce your current mortgage term It is accomplished by utilizing funds that would generally wander aimlessly through bank accounts, waiting for the purpose for which they were intended.

It is recommended that you combine a debt reduction strategy with investment recommendations to eliminate your non tax-deductible debt. This is achieved by depositing all of your employment income, dividend income and taxation refunds into the working account (personal account) of The L.O.C.

All living expenses, interest payments and other expenses will come out of this account as the income being deposited exceeds the amount of withdrawals, this will have the effect of speeding up the reduction of this non tax deductible loan amount.The investment account will be used as an interest only facility and the monthly interest payments can be made by direct debit from your working account.

Please see the diagram below illustrating how this financial strategy works by using the benefits of The L.O.C.

The L.O.C. loan is a blend of loan products that provide financial structure to facilitate the Cash Flow and Debt Management Strategy illustrated in this report.

Capital Growth.

Personal Residence.

Capital Growth Investments.

Working (Personal) Account.

Investment Income Generated.